You are here: Home / Additional modules / Billing / Billing fields and lists

€

Billing

Billing fields and lists

Inhaltsverzeichnis

The following describes which fields play a role for Faktura and how these and their lists are configured in the administration.

With the Billing module activated, the Billing tab is visible in Addresses, and in the Address there is a Billing category on the Basic data tab.

In order to create bookings and invoices for an address, certain requirements must be met, i.e. some fields in the address must be filled.

These fields are :

- Name or company

- Street

- Location

- Postal code

- Payment method

- Tax liability

- For subscriptions also payment interval

- Release invoice to “Yes” if the field is active

Without this information, no invoice can be generated.

The address requires a valid email addressfor the sending of invoices. An email address can be set as a “Billing address” type, then it will be used for sending.

In addition, the basic billing settings must be fully configured and the tax number and VAT ID must be entered under “Basic settings >> Basic data”. However, when invoicing within Germany , the invoice issuer is allowed to choose whether to display the tax number or the VAT ID on the invoice; thus, in this case, it is sufficient to indicate one of the numbers.

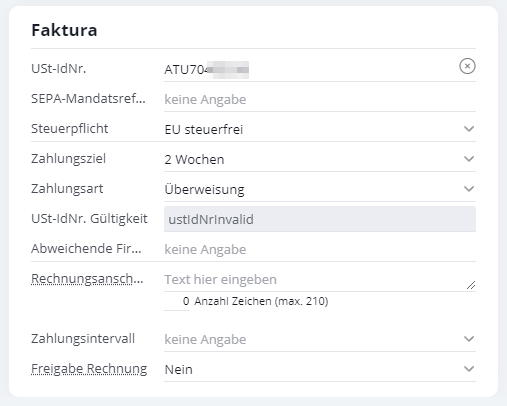

In the Billing category, on the Basic address data tab , the following fields are displayed.

- VAT no.: Sales tax identification number. By clicking on the icon to the right of the field, the validity of the VAT identification number can be checked via the European Commission interface . A valid ID is marked with a check mark, an invalid one with a cross. You can get more information by hovering the mouse over the icon. More details are listed in the activity of the address. If the VAT ID under “Basic settings >> Basic data” is from a country other than the valid VAT ID of the address, no VAT will be calculated in the invoices.

- SEPA Mandant Reference: The mandate reference, in combination with the Creditor Identifier, clearly identifies the mandate on which the direct debit is based.

- Tax liability: Possible values: Domestic, domestic tax exempt, EU, third country, §4 No. 7d UStG. Depending on the tax liability set, the documents will then show the appropriate sales tax or no tax.

- Payment term: The payment terms are defined by you in the basic billing settings and can be selected here for the address. The payment term can only be selected if the payment method is set to bank transfer.

- Payment method: The payment method can be bank transfer, direct debit, credit card or other.

- VAT no. Validity: Information about the validity and verification of the VAT registration number (e.g. ustIdNrInvalid for an invalid VAT registration number).

- Different company: different company name for the VAT identification check. Currently without function, as the VAT identification check only checks the validity of the VAT identification number.

- Billing address: A different address for invoices and credit notes can be specified here. Otherwise the normal address data will be used.

- Payment Interval: The possible values are monthly, quarterly, semi-annually, annually.

- Release Invoice: If an invoice-relevant field is edited in the address, the value is set to “No” if there is no “Release invoices” user right . Invoice relevant fields are: First name / Last name / Company / Street / Postcode / City – Country / Email Type: Billing address / language / status. A task is then sent to the user stored in “Responsibility invoice release” in the basic settings . Without the right, “Release invoice” is blocked.

- Route ID: The routing ID is an identifier of an electronic invoice for the unique addressing of public clients in Germany. The routing ID is defined by the buyer and can include, for example, a department number, a project code, contact details or an office name.

If nothing is entered here, the sales tax identification number of this address will be used. If this is also not available, ‘-‘ is used as the value.

Field Administration

Under Tools >> Settings >> Administration >> Input fields, module: Address management, category: Invoice , these fields can be managed, i.e. the names and positions of the fields can be changed or fields that are not required can be switched off.

Analogously, under Module: Invoice Item Management , the item management fields for the General, Term Conditions and Price categories can be defined. Under module: Invoice – entries are fields of an entry configurable.

List administration

On the Lists/Forms tab, the various list views for item management, postings and receipts can be customized. It is possible to set which fields should be displayed as columns in the lists. The position and column width can be adjusted as usual.

In addition to the fields from the booking, the linked address, property and task can also be selected, as well as the first name and surname of the customer being booked to.

For the voucher lists, the postings linked to the voucher can be displayed, and for the posting lists, the invoices linked to the postings can be displayed.

The button “Transfer configuration to all users” distributes the list configuration to all users, i.e. the individual list configurations are overwritten.

Types of action

On the Types of action tab, you can configure the activities generated by Faktura and customize their display.

Many actions in the invoice are recorded by activities in the addresses and properties concerned. E.g. the creation of receipts and bookings, cancellations or renewals of subscriptions or incoming payments for invoices.

The types of action for billing are document, posting and billing. About “Edit from: Kinds of action” the types of action of an type of action can be customized.

You can assign a characteristic to the kinds of action, enter costs for the activity, customize the color of the activity entry, etc.

The billing kinds of action cannot be deleted and individual kinds of action cannot be created. The activities are written exclusively by the system when the corresponding actions have been performed and cannot be edited subsequently.

Here you can find more detailed information about the administration of the types of action.

Introduction

Introduction Dashboard

Dashboard Addresses

Addresses Properties

Properties Email

Email Calender

Calender Tasks

Tasks Acquisition Cockpit

Acquisition Cockpit Audit-proof mail archiving

Audit-proof mail archiving Automatic brochure distribution

Automatic brochure distribution Billing

Billing Groups

Groups Intranet

Intranet Marketing box

Marketing box Multi Property module

Multi Property module Multilingual Module

Multilingual Module onOffice sync

onOffice sync Presentation PDFs

Presentation PDFs Process manager

Process manager Project management

Project management Property value analyses

Property value analyses Request manager

Request manager Showcase TV

Showcase TV Smart site 2.0

Smart site 2.0 Statistic Tab

Statistic Tab Statistics toolbox

Statistics toolbox Success cockpit

Success cockpit Time recording

Time recording Address from clipboard

Address from clipboard Boilerplates

Boilerplates Customer communication

Customer communication External Tools

External Tools Favorite links

Favorite links Formulas and calculating

Formulas and calculating Mass update

Mass update onOffice-MLS

onOffice-MLS Portals

Portals Property import

Property import Quick Access

Quick Access Settings

Settings Templates

Templates Step by step

Step by step